Star Health Insurance - Plans, Benefits & Features

Star Health and Allied Insurance Company Ltd. is India’s first standalone health insurance company, approved by IRDAI and trusted by millions of policyholders nationwide. Known for its strong presence in Tier 1 and Tier 2 cities, Star Health offers extensive cashless hospital access, simplified claim processes, and specialized coverage for individuals and families.

Premiums Start from

₹387

Network Hospitals

₹14,000+

Find plans starting from ₹20/day*

Self

Wife

Mother

Father

Benefits of Choosing Star Health Insurance

Star Health Insurance is known for its medical-focused approach and strong service footprint. Here’s why many Indian families choose Star Health for their healthcare protection

Pro Tip

If you live in a Tier 2 or Tier 3 city, Star Health’s strong regional hospital network can be a key advantage.

Know More About Star Health Insurance Plans

Star Super Star Health Insurance

Star Super Star stands out for its modular benefits, restoration features, and high degree of customization, making it a strong choice for individuals and families who want long-term, adaptable health protection.

Key Features

- Hospitalization Cover - Covers in-patient treatment expenses including room rent, doctor fees, ICU stays, procedures & more

- Freeze Your Age Benefit - Locks in your entry age so premiums remain based on the entry age until the first claim or age 55, whichever is earlier

- Automatic Sum Insured Restoration - After a claim, your sum insured is automatically restored up to 100%, with no annual limit

- Road & Air Ambulance - Covers ambulance charges for necessary transport. Air ambulance expenses are covered up to a defined limit

- Day Care & AYUSH Treatments - Day care procedures and AYUSH treatments are included, subject to policy conditions and list of procedures

- Cash-Bag Benefit: Earn back a portion of your premium through healthy lifestyle rewards

- Tele-Consultation & Digital Health Tools - Teleconsultations and AI-driven vital scans are available

How to Claim Star Health insurance

Step 1

Get admitted to a network hospital

Step 2

Hospital sends pre-auth request to Star Health

Step 3

Approval is communicated directly to hospital

Add-ons Available with Star Health

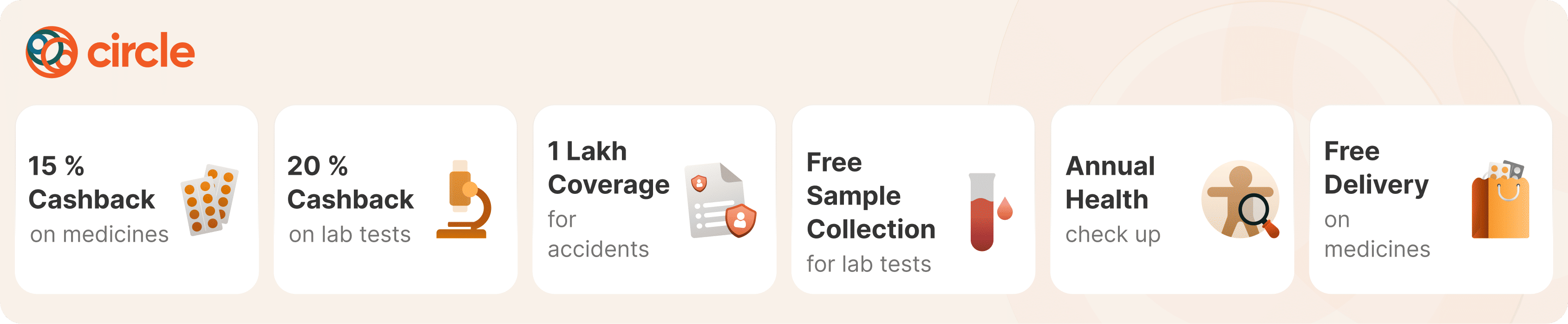

Why Buy from Apollo

Unlock Apollo Exclusive Benefits

FAQs

Is Star Health Insurance good for first-time health insurance buyers?

Do I need a medical check-up to buy Star Health Insurance at a young age?

Why should I buy health insurance early with Star Health?

Does Star Health Insurance cover day care procedures?

Can I upgrade or customize my Star Health policy later?

Can I cover my spouse and children under one Star Health policy?

Does Star Health Insurance cover maternity expenses?

Does Star Health Insurance cover pre-existing diseases?

Can waiting periods for pre-existing diseases be reduced in Star Health plans?

Are lifestyle diseases like diabetes or high blood pressure covered under Star Health plans?

Is Star Health Insurance suitable for senior citizens?

Are there room rent limits under Star Health Insurance?

Does Star Health Insurance provide cashless hospitalization across India?

What is the difference between cashless and reimbursement claims?

Insurance benefits, features, and eligibility are subject to insurer terms, IRDAI regulations, and policy documents. Please read all details carefully before purchasing

Quick Links

- Benefits of Choosing Star Health Insurance

- Know more about Star Health Insurance Plans

- How to Claim Star Health insurance

- Add-ons Available with Star Health